5000 Rupee Note: ₹5000 note on New Year? RBI broke silence, know the whole truth

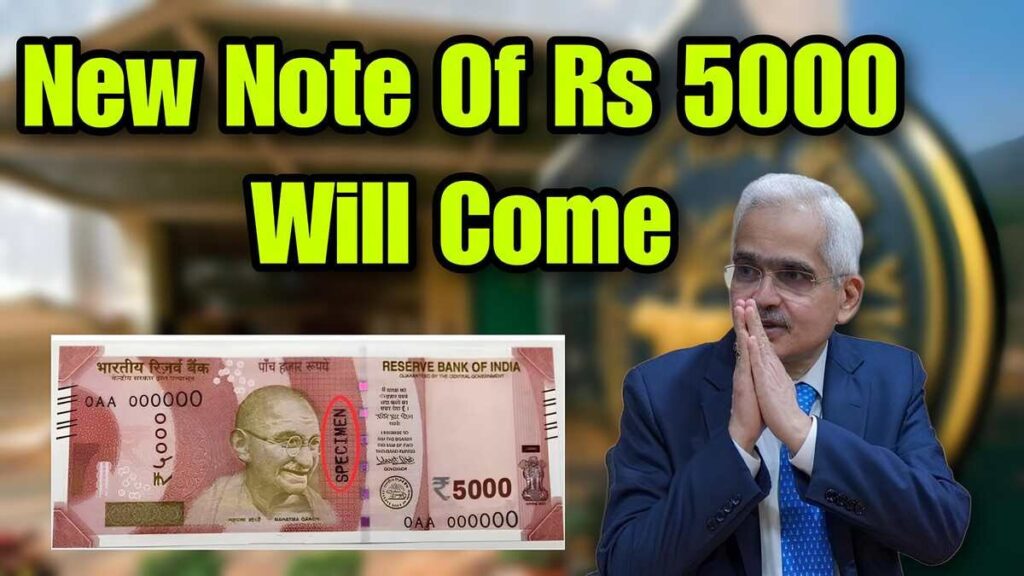

Ever since demonetization in India, people are very curious about currency and new notes. Recently a news is going viral on social media that the Reserve Bank of India (RBI) is going to issue a new note of Rs 5000 in the new year 2025. This news is spreading rapidly and people are curious to know its truth.

In this article, we will know the truth of this viral news and understand whether RBI is really planning to bring a new note of Rs 5000. Along with this, we will also discuss the Indian currency system, the process of printing notes and other important aspects related to it. Let us know all the information related to this issue in detail.

5000 Rupee Note: Truth of the viral news

First of all, it is important to know that the news spread about the 5000 rupee note is completely a rumor. The Reserve Bank of India has denied any such proposal or plan. RBI has clarified that at present there is no plan to issue a new note of Rs 5000.

Source and spread of viral news

The rumour spread rapidly on social media platforms such as WhatsApp, Facebook and Twitter. Some fake websites also published the news, giving it further credence. But all this was done without any official confirmation.

Table of Contents

RBI official statement

The Reserve Bank of India has denied this rumour by issuing a press release. RBI has said:

“It has come to our notice that news is being circulated on social media regarding a new Rs 5,000 note. We would like to clarify that there is no such plan and this news is completely baseless.”

Indian Monetary System: An Overview

Understanding the Indian monetary system is important in the context of this issue. Here is a brief overview:

| Description | Information |

| Name of the currency | Indian Rupee (INR) |

| currency issuing authority | Reserve Bank of India (RBI) |

| currently circulating notes | ₹10, ₹20, ₹50, ₹100, ₹200, ₹500, ₹2000 |

| Largest denomination | ₹2000 |

| Languages printed on the notes | Hindi and English |

| coins | ₹1, ₹2, ₹5, ₹10, ₹20 |

| currency symbol | ₹ |

Process for issuing new currency notes

Issuing new currency notes is a complex and lengthy process. It involves several stages and regulatory bodies:

- Assessing the need: RBI first assesses whether there is a need for the new denomination notes.

- Approval from Government: It is mandatory to take permission from the central government.

- Design and security features: New notes are designed and equipped with high security features.

- Printing: Notes are printed based on the approved design.

- Distribution: The new notes are distributed to the public through banks.

- Public awareness: RBI educates the public about the features of the new note.

Possibility of 5000 rupee note: Analysis

Although there are currently no plans to issue a Rs 5000 note, it may be interesting to consider the possibility:

potential benefits

- Convenience in large transactions: Higher value notes can facilitate large transactions.

- Reduction in printing costs: Printing smaller numbers of high value notes can reduce costs.

- Ease of cash handling: Cash management can become easier for banks and ATMs.

Potential harm

- Increase in black money: High value notes may lead to increase in illegal activities and black money.

- Risk of inflation: Higher denomination notes may pose a risk of inflation.

- Impact on digital transactions: This may contradict the government’s efforts towards a cashless economy.

Indian Economy and Monetary Policy

Understanding Indian economy and monetary policy is important in this context:

Current economic situation

- India is the 5th largest economy in the world.

- The GDP growth rate is estimated to be around 6.5% in 2024-25.

- The target is to keep the inflation rate within 4% (+/- 2%).

Monetary Policy of RBI

- Repo Rate: Currently 6.5% (till January 2025)

- Reverse Repo Rate: 3.35%

- Bank Rate: 6.75%

- CRR (Cash Reserve Ratio): 4%

- SLR (Statutory Liquidity Ratio): 18%

Impact and learnings of demonetisation

India has learned several lessons from the 2016 demonetisation:

- Importance of digital transactions: Growth of UPI and other digital payment modes.

- Impact on economy: Faced a short-term economic slowdown.

- Control over black money: Black money was curbed to some extent.

- Reforms in banking sector: Deposits in banks increased and KYC process became stronger.

- Cash Management: RBI and banks realised the need for better cash management.

The currency of the future: the digital rupee

India is now moving towards digital currency. RBI has introduced Central Bank Digital Currency (CBDC) or Digital Rupee:

Features of Digital Rupee

- Digital form of physical currency: This is the electronic version of physical notes.

- Blockchain technology: It has advanced security features.

- Instant transactions: Real-time fund transfer is possible.

- Low cost: Low transaction costs.

Benefits of Digital Rupee

- Transparency: All transactions are recorded, thereby increasing transparency.

- Ban on counterfeit currency: Being digital eliminates the problem of counterfeit notes.

- Financial Inclusion: It will be easier to provide banking services even in remote areas.

- Currency Management: It will be easier for RBI to manage the demand and supply of currency.

Disclaimer

This article is for informational purposes only. The news about the Rs 5000 note is completely a rumor and has no official basis. The Reserve Bank of India (RBI) has clarified that there are currently no plans to issue any such new notes. Readers are requested to rely only on information received from official sources and not spread rumors. Refer to the official website or press releases of RBI for any information related to currency.

Trending Topics

A trending topics blog offers a variety of current and engaging news updates across multiple categories. From exam vacancies, government jobs, and career advice to astrology insights, business trends, and stock market updates, it covers it all. Additionally, it keeps readers informed about daily lifestyle tips, sports highlights, national and world news, entertainment buzz, cybercrime awareness, and government schemes. This platform ensures a comprehensive mix of information for every interest.

No Comment! Be the first one.